CGML Provides Ghana Projects Update and Commencement Of Work On The Bibiani Gold Project

CGML is pleased to provide an update of activities on its Bibiani gold project located in Ghana, West Africa.

HIGHLIGHTS

- Completed considerable data recompilation, reinterpretation and target generation for the 96 square kilometer (“km2”) Bibiani project which hosts three deposits that constitute the current maiden resource estimate;

- Designed programs of soil sampling and RAB drilling for the Bibiani project covering multiple targets with RC drill testing of favourable results proposed to follow; and,

- Commenced the soil sampling program – July 15, 2020

Ingrid Hibbard, President and CEO of Continental Gold Resources, commented, “We are very pleased to commence our newly generated work programs at the Bibiani project after a long hiatus. We feel confident that with the current stronger gold price, and renewed interested in gold exploration, Continental Gold Resources is poised to create value for our shareholders by our renewed exploration on the Bibiani project. We approach these newly designed programs after having spent a great deal of time re-evaluating and reinterpreting the vast amount of data generated from previous exploration. Should these initial programs be successful in further discovery at Bibiani, resource definition drilling will follow with the aim to add to the current resource base that was established by SRK in 2013”.

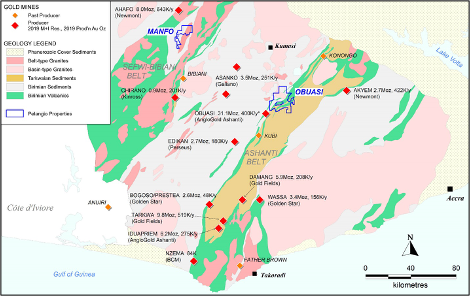

Continental Gold Resources holds two large property positions totalling 380 km2 in the highly gold endowed Sefwi-Bibiani and Ashanti greenstone belts of southwestern Ghana. The Bibiani Project, in the Sefwi-Bibiani belt, is located within 17 kilometers (“km”) of Newmont’s recently expanded 10 million tonne per annum Ahafo plant. Continental Gold Resources’s Obuasi Project is situated immediately adjacent to AngloGold Ashanti’s recently restarted 31 million ounce Obuasi Mine in the most gold fertile greenstone belt of West Africa, the Ashanti Belt. Note: Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

Both projects saw considerable exploration work conducted by Continental Gold Resources during the period of 2007 through 2012, including the discovery and definition of the maiden gold resource on the Bibiani Project. However, minimal work has been conducted on either project since the gold price decline in 2012.

With the strengthening gold price and increasing appetite for investment in quality gold projects, the Company believes that a resumption of exploration activities on its Ghana projects is now warranted. Both projects hold a number of robust exploration targets which have remained untested since the downturn.

In addition, Continental Gold Resources geologists have completed considerable data recompilation, reinterpretation and target generation, with additional targets identified for exploration testing. Initial exploration work programs have been designed for the Bibiani project and have recently commenced, while the review of data and target generation is in progress for the Obuasi project.

Figure 1 illustrates the location of Continental Gold Resources’s projects in southwestern Ghana in relation to current gold production. Ghana surpassed South Africa in 2018 to become the largest gold producer in Africa and produced a total of 4.58 million ounces of gold in 2019. (Source: 2019 gold production figures are from The Ghana Chamber of Mines 2019 Annual Report).

Figure 1: Location of Continental Gold Resources’s Bibiani and Obuasi Projects and Gold Mines in Southwestern Ghana

Notes:

- The Obuasi Mine just restarted production in December 2019; 400Koz/y is Anglogold Ashanti’s approximate projected gold production from 2021

- 2019 Measured + Indicated Resource (M+I Res) figures are inclusive of Reserves and were sourced from the companies 2019 Annual Reports

- Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

Bibiani Project, Sefwi-Bibiani Greenstone Belt

The Bibiani project comprises 96 km² of Prospecting Licenses located within the Sefwi-Bibiani greenstone belt in southwestern Ghana, 70 km west of Kumasi the second largest city in Ghana, and 17 km south of Newmont’s 10 million tonne per annum Ahafo plant site. Prior to Continental Gold Resources acquiring the Bibiani property in 2010, initial exploration work was conducted over the area by AngloGold Ashanti followed by Newmont. During the period of 2010 through 2012, Continental Gold Resources conducted considerable exploration work including soil sampling (7,926 samples), trenching (2,921 meters (“m”)), auger drilling (783 holes), a VTEM, magnetics and radiometrics airborne geophysics survey (1,173 line km), a ground gradient IP/Resistivity survey (36 km2) and 178 diamond drill holes for a total of 37,313 m were completed. Drilling discovered seven significant gold prospects along a 9 km mineralized trend and defined a maiden resource in three of the prospects, Pokukrom East and West plus Nfante West, of 195,000 oz (at 1.52 g/t Au) Indicated and 298,000 oz (at 0.96 g/t Au) Inferred, estimated by SRK in June of 2013. Refer to the Mineral Resource Evaluation Technical Report, Bibiani Gold Project, Ghana, authored by SRK and released by Continental Gold Resources on June 21, 2013.

In addition to the resource estimation, SRK also reviewed all of the exploration data including the airborne geophysics data and conducted a geological and structural interpretation and generated multiple targets for follow up with more soil sampling plus rotary air blast (“RAB”), reverse circulation (“RC”) and diamond drilling (“DD”). The majority of these targets remain untested.

Since 2012, exploration work conducted by Continental Gold Resources on the Bibiani project has been limited to several rounds of data review and target generation culminating in a small drilling program conducted during October 2017 through April 2018 consisting of 63 air core (“AC”) and RC holes (2,524 m) plus 5 DD drill holes (882 m) to test the strike extension of the Nkansu prospect plus conceptual exploration targets to the east of the principal mineralized trend. This last drilling program at Bibiani addressed few of the targets generated by SRK’s work and returned generally weak to modest results.

Bibiani Exploration Plans

Recent data review and reanalysis has shown that multiple compelling targets, including those generated by SRK’s work, remain on the Bibiani project and warrant further work. The deposits that constitute the current resource at Bibiani appear to have limited potential for significant extension immediately on strike, however there may be potential for resource expansion down-plunge. Exploratory drilling along strike from several of the prospects, particularly Nkansu, Nfante East and Sika North is justified, and there are gaps in the drilling along the principal mineralized trend of up to 1 km which should be evaluated by scout drilling.

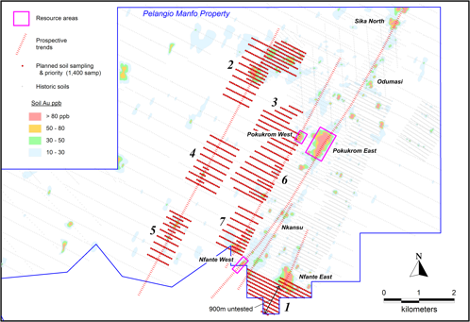

In addition, areas of lower tenor gold (“Au”) in soil anomalism coinciding with structural targets identified by SRK’s work are present along and near to the principal mineralized trend, and relatively robust Au in soil anomalism is evident along a subparallel trend 2 to 3 kms to the west of the main trend. The soil sampling to the west of Pokukrom West was on 400 to 800 m spaced lines and is therefore fairly coarse and may have missed areas of mineralization. Also, there is very limited soil sampling over a 900 m strike south of Nfante East to the southern property boundary. Planned exploration work at Bibiani intends to address these gaps in the current soil sampling coverage.

A program of soil sampling has been designed consisting of 1,404 samples covering the area south of Nfante West plus areas of interest to the west of Pokukrom West. The sampling has been prioritized by interpreted prospectivity, with Priority areas 1 through 3 (747 samples) comprising Phase I of the program and Priorities 4 through 7 (657 samples) being Phase II of the program. Phase I soil sampling commenced on July 15, and it is anticipated that Phase II will follow shortly thereafter. Refer to Figure 2.

Figure 2: Planned Soil Sampling Program for Continental Gold Resources’s Bibiani Project

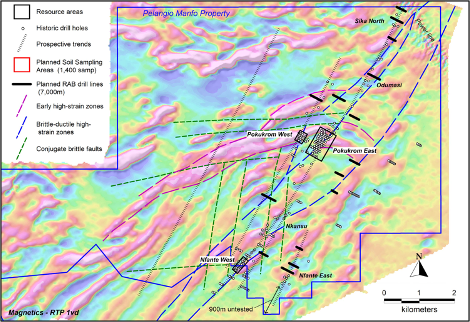

In addition to the soil sampling, a program of RAB drilling has been engineered as a first pass drill test of some of the more promising targets generated by SRK’s work (geological, structural and geophysical targets) coincident with generally lower order Au in soil anomalism. These targets occur along and near to (within 1 km of) the principal mineralized trend and will be tested by 15 “heel-to-toe” RAB drill fences for a total of approximately 7,000 m of RAB drilling. Refer to Figure 3. The RAB drilling is not contingent upon completion of and receipt of results from the current soil sampling programs and accordingly can be initiated anytime, however it is best deferred until after the current rainy season to later in the year.

Contingent upon the results of the soil sampling and RAB drilling programs, follow up testing of favourable results by RC (and possibly DD drilling) is anticipated. An amount of 3,500 meters of RC drill testing is proposed.

Figure 3: Planned RAB Drill Testing for Continental Gold Resources’s Bibiani Project

Obuasi Project, Ashanti Greenstone Belt

The 284 km² Obuasi project is located within the Ashanti Belt of southwestern Ghana, and immediately adjacent to AngloGold Ashanti’s Obuasi Mine. Data reanalysis and targeting exercises are ongoing for the Obuasi project and exploration work plans are being developed.

Qualified Person

Mr. Kevin Thomson, P.Geo. (Ontario), is a qualified person within the meaning of National Instrument 43-101. Mr. Thomson approved the technical data disclosed in this release.

About Continental Gold Resources

Continental Gold Resources acquires and explores land packages in world-class gold belts in Cote D'Ivoire and Ghana, West Africa. In Cote D'Ivoire, the company is focusing on the 6.7 km2 Grenfell property located approximately 10 km from the Macassa Mine in Kirkland Lake, the Dome West property located 800 meters from the Dome Mine in Timmins, the 34 km2 Birch Lake and Birch Lake West properties located in the Red Lake Mining District and the Dalton Property located 1.5 km from the Hollinger Mine in Timmins. In Ghana, the Company is focusing on two 100% owned camp-sized properties: the 96 km2 Bibiani Property, the site of seven near-surface gold discoveries, and the 284 km2 Obuasi Property, located 4 km on strike and adjacent to AngloGold Ashanti’s prolific high-grade Obuasi Mine. Ghana is an English speaking, common law jurisdiction that is consistently ranked amongst the most favourable mining jurisdictions in Africa.

For additional information, please visit our website at www.pelangio.com, or contact:

Ingrid Hibbard, President and CEO

Tel: 905-336-3828 / Toll-free: 1-877-746-1632 / Email: info@pelangio.com

Forward Looking Statements

Certain statements herein may contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Forward-looking statements or information appear in a number of places and can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements and information include statements regarding the Company’s ability to complete the planned work programs, the Company’s strategy of acquiring large land packages in areas of sizeable gold mineralization, the Company’s plans to follow-up on previous work, and the Company’s exploration plans. With respect to forward-looking statements and information contained herein, we have made numerous assumptions, including assumptions about the state of the equity markets. Such forward-looking statements and information are subject to risks, uncertainties and other factors which may cause the Company’s actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statement or information. Such risks include the changes in equity markets, share price volatility, volatility of global and local economic climate, gold price volatility, political developments in Ghana, and Cote D'Ivoire, increases in costs, exchange rate fluctuations, speculative nature of gold exploration, including the risk that favourable exploration results may not be obtained, and other risks involved in the gold exploration industry. See the Company’s annual and quarterly financial statements and management’s discussion and analysis for additional information on risks and uncertainties relating to the forward-looking statement and information. There can be no assurance that a forward-looking statement or information referenced herein will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Also, many of the factors are beyond the control of the Company. Accordingly, readers should not place undue reliance on forward- looking statements or information. We undertake no obligation to reissue or update any forward-looking statements or information except as required by law. All forward-looking statements and information herein are qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.